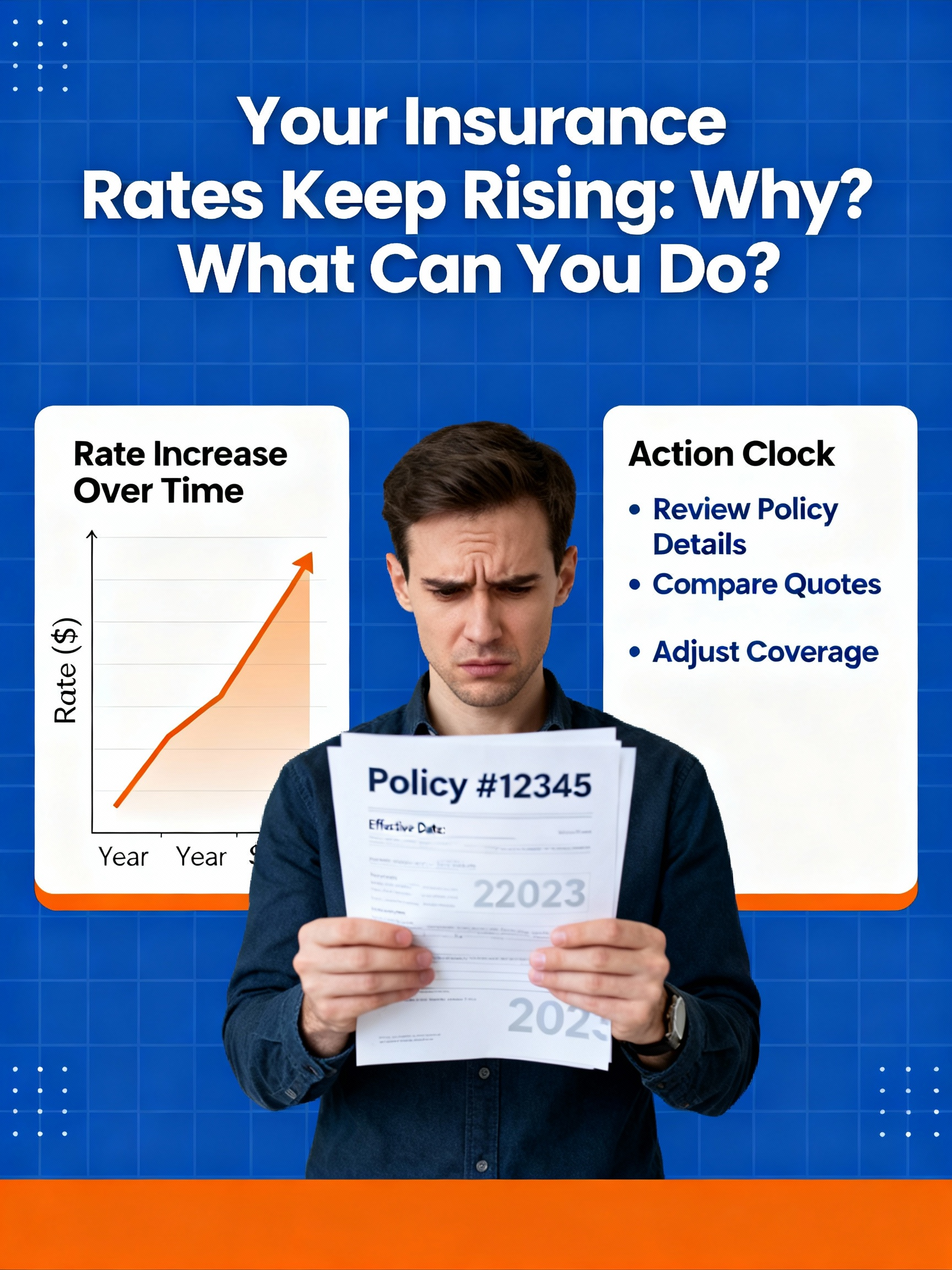

Why Car Insurance Rates Are Rising — And How to Lower Yours

Published Date: 05/03/2024

Inflation, technology and shifting driving habits have pushed auto insurance premiums higher nationwide. In fact, rates have jumped more than 30% in just a few years. The good news? There are still ways to reduce what you pay. Here’s why costs are up—and what you can do about it before your next renewal.

Why Auto Insurance Costs Keep Increasing

Inflation and Higher Repair Costs

Inflation has surged for several years, affecting everything from groceries to car repairs. When the cost of parts, labor and materials increases, so does the cost for insurers to fix vehicles—and those expenses trickle down to consumers.

Expensive Vehicle Technology

Modern vehicles are packed with cameras, sensors, advanced safety systems and smart tech. While these features improve safety, they’re expensive to repair and require highly trained technicians. More costly repairs mean higher premiums.

More Frequent and Severe Claims

Since the pandemic, accidents have become both more common and more costly. The era of shrugging off a scratched bumper is long gone—drivers increasingly pursue compensation after even minor collisions, which drives premiums up for everyone.

Riskier Driving Habits

Despite remote work’s popularity, Americans are logging more miles than ever. More time on the road means more opportunities for accidents. Distracted driving—especially phone use—continues to rise, contributing to more claims and higher rates.

Ways to Potentially Lower Your Auto Insurance Premium

Reevaluate Your Physical Damage Coverage

If your car isn’t worth much, you may not need collision or comprehensive coverage. Removing it could save hundreds per year. If you do keep full coverage, increasing your deductible to $1,000, $2,500 or more can significantly reduce your premium.

Bundle Multiple Policies

Insurers love when you bring them more business. If you have a home, condo or renters policy, see whether the same carrier can also insure your car. Bundling typically lowers premiums on both policies.

Update Your Annual Mileage

Many drivers no longer commute daily. If you work from home or drive far less than before, ensure your insurer is rating your policy based on your true mileage—not the numbers from years ago. Fewer miles usually means a lower rate.

Ask for All Available Discounts

Insurers don’t automatically apply every discount you qualify for—you have to ask. Send your agent or carrier a simple request:

“Please list all discounts available on my auto insurance policy.”

Then review the list to see what you already have and what you may be missing. You might uncover savings you didn’t know existed.

Take Control of Your Auto Insurance Costs

No one should expect to pay the same rates they did decades ago, but you can influence what you pay today. Review your coverage, ask questions, compare options and stay proactive. It’s your policy and your money—make sure you’re getting the best value for both.

Author